Trade Readjustment Allowance (TRA) benefits are similar to regular unemployment benefits. You must apply for and exhaust regular unemployment benefits before applying for TRA benefits. If eligible for TRA benefits, you may request them only after you receive all of your regular unemployment insurance benefits in a benefit year.

Depending on the petition number of your trade program, claimants may receive up to several years of combined regular unemployment and TRA benefits. Trade Readjustment Allowance benefits vary depending on past wages and other requirements.

There are three types of TRA benefits:

- Basic

- Additional

- Completion

To be eligible for TRA benefits, you must be participating in Trade Adjustment Assistance (TAA) approved training. You must attend TAA training classes as scheduled. However, if your school has scheduled breaks for holidays or summer vacation that exceed 30 class days, TWC cannot pay you any level of trade benefits for the weeks covered by those 30 days. TWC can pay Basic and Additional TRA during breaks less than 30 days.

How to Apply

To apply for Trade Readjustment Allowance benefits, complete and return a Trade Readjustment Allowance Application. You must submit an application for regular benefits on ui.texasworkforce.org before we can take a TRA application.

Types of TRA Benefits

The following sections provide information on the different types of TRA benefits.

We pay Basic TRA benefits when your regular unemployment benefits end. You can receive up to 52 weeks of combined regular and basic TRA benefits. You have two years (104 weeks) after separating from a trade-affected employer to use basic TRA benefits and receive payment, if you are eligible.

Eligibility

To qualify for Trade Readjustment Allowance benefits you must have applied for TAA-approved training within specific deadlines.

- For petitions numbered 70,000 or higher, you apply for TAA-approved training or have a waiver of the training requirement within 26 weeks of your separation from a trade-affected employer or the date the petition is certified (the date the employer was certified as trade-affected), or

- Prior to your waiver / in-training deadline date, your career counselor gives you a form that temporarily exempts you from training for a specific qualifying reason.

To qualify for basic Trade Readjustment Allowance benefits, you must meet one of the following criteria:

- Be enrolled in Trade Adjustment Assistance (TAA) approved training

- Be participating in TAA-approved training

- Have completed TAA-approved training and obtained a degree or certification

- Have a written certification waiving the training requirement

Additional Trade Readjustment Allowance benefits are available subject to the following requirements. The details of these benefits are also explained.

Eligibility

To qualify for Additional Trade Readjustment Allowance benefits, you must satisfy all of the following requirements:

- You qualified for Basic TRA.

- You must be attending TAA-approved training.

- For petitions numbered 85,000 or higher, you must use your Additional TRA benefits within 65 weeks after basic TRA ends.

- For petitions numbered 80,000 or higher, you must use your Additional TRA benefits within 78 weeks after basic TRA ends.

- For petitions numbered 70,000 to 79,999, you must use your Additional TRA benefits within 91 weeks after basic TRA ends.

Benefits

- If your petition is numbered 80,000 and higher:

At the end of Basic TRA or beginning with TAA-approved training, TWC may be able to pay you up to 65 weeks of Additional TRA or pay you until you complete training, whichever comes first. - If your petition is numbered 70,000 to 79,999:

At the end of Basic TRA or beginning with TAA-approved training, TWC may be able to pay you up to 78 weeks of Additional TRA or pay you until you complete training, whichever comes first.

Completion Trade Readjustment Allowance benefits are available subject to the following requirements. The details of these benefits are also explained.

Eligibility

To qualify for Completion TRA, you must meet all of the following requirements:

- Be in a TAA-approved training program leading to completion of a degree or industry recognized credential.

- Participate in TAA-approved training each week.

- Meet the performance benchmarks established as part of your training program.

- Continue to make progress toward completion of the training during this additional period,

- Complete the training program during the time you receive Completion TRA.

Benefits

If your petition is numbered 80,000 and higher:

- If you need additional time to complete your TAA-approved training, you may qualify for Completion TRA. Completion TRA is an additional 13 weeks of TRA benefits payable within a 20-week period.

- Completion TRA is payable for weeks you are attending TAA-approved training. TWC cannot pay Completion TRA for weeks during a scheduled break.

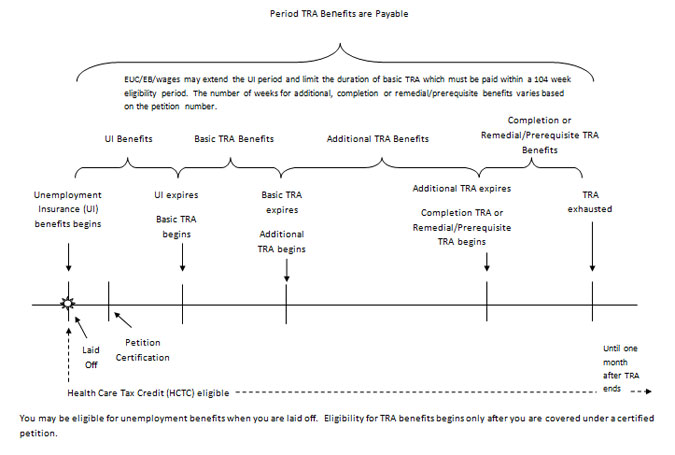

The chart below shows the progression of benefits by type.

Your claim is confidential. However, we share some information with government agencies and their contractors for the administration and enforcement of laws, including verifying eligibility for public assistance, supporting law enforcement activities, and other purposes permitted by law. Allowable uses of confidential information may include performing statistical analysis, research and evaluation.

Disclosure may be made to entities that manage and evaluate programs such as Social Security, Medicaid, nutrition assistance, and child support. We mail a notice of your claim to your last employer and may communicate with other former employers. If we pay you benefits by debit card, we share information with U.S Bank because it manages your debit-card account. U.S. Bank and government agencies with access to information must agree to comply with state and federal laws regarding the confidentiality of claim information.