If you received an overpayment notice for a claim you did not file, you should report the unemployment identity fraud using TWC’s online portal. Once TWC confirms that a claim was filed using a stolen ID, the individual named on the claim is not responsible for any overpayment.

An overpayment is caused when Texas Workforce Commission (TWC) pays unemployment benefits that you were not eligible to receive. State law requires TWC to recover all unemployment benefits overpayments.

There is no statute of limitations on debts owed to the state. TWC cannot forgive or dismiss the overpayment and there is no exception for hardship.

Overpayments stay on your record until repaid. You must repay those benefits even if the overpayment was not your fault. We cannot pay you benefits if you have an overpayment.

If we determine that the overpayment is from unemployment fraud you committed, you will be required to repay the benefits you were not eligible for, plus a 15 percent penalty on the benefits you incorrectly received. For more information, see Unemployment Benefits Fraud.

| Causes of Overpayments |

|---|

| Not reporting earnings or reporting incorrect earnings when requesting benefit payments. |

| Correction of wage errors resulting in a lower benefit amount than initially determined because the wage history we used to establish your claim included errors or belonged to another individual. |

| Providing incorrect or false information about your job separation or work search when you applied for benefits or requested payment. |

| Having an appeals ruling reverse your eligibility after TWC paid you benefits. |

| Not participating in Reemployment Services or other job assistance programs with Workforce Solutions when required. |

| Not registering with WorkInTexas.com or with your local One-Stop Career Center if residing outside of Texas. |

| Committing fraud. |

Resources

Impact on Current Benefits

State law requires that you repay your overpayment before we can pay further unemployment benefits. TWC cannot dismiss or forgive an overpayment, and there is no exception in the law for hardship cases. If you are requesting unemployment benefits, we recommend that you continue to submit biweekly payment requests so we can apply each eligible payment toward the overpayment until it is repaid.

Overpayments From Another State

If you have an overpayment of unemployment benefits in another state, that state may request that we send your Texas benefits to them until your overpayment is paid. If the overpayment from another state can be collected by Texas, we will notify you. Continue to submit biweekly payment requests so we can apply each eligible payment toward the overpayment. After you repay the overpayment, we will release any remaining payable benefits to you, as long as you are still requesting payment.

Unemployment Benefits From Another State

If you have an overpayment in Texas and receive unemployment benefits from another state, we can ask that state to recover the money for us. The other state will send your benefits to TWC to repay your overpayment, as allowed by the laws of the other state.

More About Overpayments

Learn more about overpayments in the sections below.

If you have an overpayment, we mail you a Determination on Payment of Unemployment Benefits letter explaining the reason for your overpayment, what weeks were overpaid, and the amount of money you must repay.

Within 30 days of the date we determine that you have an overpayment, we mail a Statement of Overpaid Unemployment Benefit Account (billing statement), with instructions on how to repay the overpayment. Approximately 30 days later, we mail a second billing statement with a repayment schedule, unless your case is being prosecuted.

Find information about Federal Pandemic Unemployment Compensation (FPUC) overpayments.

You may appeal any TWC determination that says we cannot pay you benefits or you have an overpayment. For appeal information, see your Determination on Payment of Unemployment Benefits or our Introduction to Unemployment Benefits Appeals page.

Repayment During an Appeal

If you are requesting benefits, we will apply each eligible payment toward reducing your overpayment. If the appeal decision reverses or changes the overpayment amount, we will adjust the overpayment, as needed.

If you are not requesting benefits, you are not required to send payments during the appeal process. If the appeal decision upholds the overpayment, you must begin repaying the overpayment. If TWC reverses or changes the overpayment amount, we will adjust the overpayment as needed.

We will send you monthly billing statements as long as you consistently make payments. If we do not receive repayment or speak with you within 30 days of mailing your second billing statement, we will not continue to mail billing statements. However, the overpayment stays on your claim record and state law requires that we continue to take action to recover the overpayment until repaid.

Billing Statements for Multiple Claims

If you have overpayments on multiple claims, we send a separate billing statement for each claim. We cannot provide a combined statement. However, you may add the amounts together and pay with one check each month.

Overpayments from Past Unemployment Periods

You may receive an overpayment billing statement even if you have not applied for unemployment benefits recently. The Texas Constitution requires that all debts owed to the state be repaid, with no statute of limitations.

When we receive updated information, we mail a billing statement as a reminder to pay the debt. For example, when an employer reports hiring you for a new job, we mail you a statement as a reminder about the overpayment.

Overpayment Notice on ID Fraud Claims

If you receive a “Statement of Overpaid Unemployment Benefits Account” (overpayment notice) for an unemployment benefits claim that you did not file, you should report the ID fraud claim on TWC’s online Fraud Submission portal. See Unemployment Benefits ID Fraud for more information.

Once TWC confirms that a claim was filed using a stolen ID, the individual named on the claim is not responsible for any overpayment and the employer’s tax rate or reimbursement is not affected. Once ID fraud is confirmed, any future overpayment statements will be suspended. However, you may continue to receive billing statements while the investigation is ongoing.

You do not need to respond to these statements if you have already reported the ID fraud using the fraud submission portal.

It is important to promptly repay an overpayment because:

- The overpayment stays on your claim record until you repay it in full.

- If you apply for benefits, TWC will apply each eligible payment toward reducing your overpayment until the overpayment is repaid.

- The Texas State Comptroller can recover your overpayment by withholding certain payments to you. That means the state cannot pay you lottery winnings, unclaimed property, unemployment benefits, or state job-related expenses, except for wages, until you repay the overpayment in full.

- Some state funding for college students cannot be released until you repay the overpayment in full.

Repayment if Requesting Benefits

If you are requesting benefits, TWC will apply each eligible weekly benefit payment toward repaying your overpayment until it is repaid.

If you previously established a repayment schedule, we will cancel the repayment arrangements you made before beginning your claim if we are offsetting all or part of your weekly benefit amount to repay the overpayment. If desired, you can make additional payments directly to TWC to repay your overpayment debt sooner. We are not able to change the amount that is offset from your benefits.

Repayment Schedule

If you cannot repay the entire overpayment amount at once, a payment schedule is provided on the Statement of Overpaid Benefits Account notice that TWC sends to you. You do not need to contact TWC for the repayment schedule to take effect. To start payment under the schedule, submit the amount shown in the Minimum Payment Due section of the form.

If you cannot repay the Minimum Payment amount, contact TWC to ask whether your repayment schedule can be revised. If your overpayment meets certain criteria, we may be able to adjust the minimum payment. If you are unable to pay the minimum amount, we suggest you send as much as you can. All payments are accepted and used to reduce the amount owed. See Contact Information below.

If you are filing for unemployment benefits, TWC will use each eligible weekly payment to repay your overpayment, called offsetting. Benefits will continue to be offset as long as an overpayment exists, regardless of the payment schedule.

TWC accepts payments for an unemployment benefit overpayment online by debit card, e-check or by mail. We cannot accept payment by phone, credit card, or PayPal.

If you are requesting benefits, TWC will also use each eligible payment and apply it toward repaying the overpayment until the balance is paid in full. TWC calls this benefit offsetting. Benefits will continue to be offset as long as an overpayment exists, regardless of any additional payments you may submit.

Online Payments - E-check

An E-check is an electronic payment sent directly from your bank or credit union to TWC, also known as ACH (Automated Clearing House) or EFT (Electronic Funds Transfer). Paying by E-check is a safe and convenient method for repaying your unemployment benefits overpayment. You may repay the overpayment in full, or submit the minimum monthly payment, which is shown on the Statement of Overpaid Unemployment Benefits Account letter that TWC sent to you. Payments are processed through a third-party vendor and may take four to five days from the date you make the payment until it is posted to the overpayment on your unemployment benefits account.

There is no additional charge for submitting your payment using E-check.

To submit an E-check payment:

- Logon to Unemployment Benefit Services (UBS).

- If you have not registered with UBS, you must first create a User ID and password, then wait 30 minutes before submitting your payment online. This ensures the current overpayment balance is available when submitting your payment.

- To submit a payment online, your UBS profile must include a valid email address. Go to your UBS Profile to add or verify your email address.

- Select “Make a Payment on Your Overpayment” from the Quick Links section.

- Enter your UBS log on credentials (again) to logon to the payment portal.

- Select the Payment Type: Electronic Check

- You will be redirected to Texas.gov, which is the official website for the state of Texas, where you will enter your payment information.

- Complete the Customer Information with your name, address, phone number, and email address.

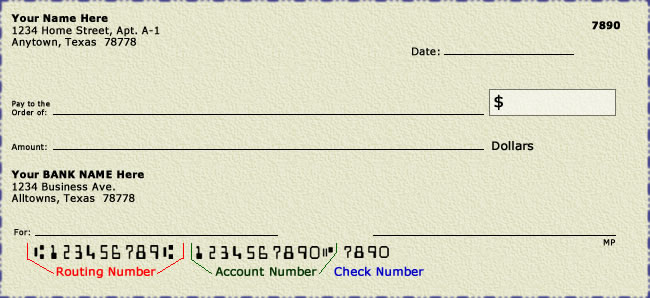

- Complete the Payment Information with the name on the bank or credit union account, routing number, and account number. The banking information you provide to Texas.gov is not given to TWC.

- Note: If your bank account is under a different name (maiden name, spouse, partner, parent, etc.), you should enter the name as it appears on the account. The name on the bank/credit union account does not need to match the name on the unemployment benefits claim.

- Enter the amount of your payment and submit the payment. You must select the Next and Continue buttons until the TWC confirmation number is given.

- Write down or print the TWC Payment Receipt Confirmation number for your records. You will receive an email from Texas.gov with details of the payment you submitted. Once the payment is processed through our third-party vendor, TWC will apply the payment to your unemployment benefits claim account. Payment is usually applied to your overpayment within four to five business days from the date you make your payment.

You may repay your overpayment by mailing a personal check, cashier’s check, or money order. To ensure proper credit, write your name, last four digits of your Social Security number, and the account number shown on your billing statement on your check or money order.

There is no additional charge for submitting your payment by check or money order.

Make your check or money order payable to “Texas Workforce Commission.”

Mail your check or money order to:

TWC Revenue & Trust Management

P.O. Box 149352

Austin, TX 78714-9352

To request a receipt, contact Benefits Overpayment Collections at 512-936-3338.

Electronic Bill Pay Through Your Bank

Many banks and credit unions offer online electronic bill pay to their customers. If your bank or credit union offers this service, you may be able to set up bill pay for a one-time payment or monthly payments. Each bank or credit union will have its own rules, but generally, you will log into your bank’s bill pay platform and enter TWC’s payment address (shown above) and your TWC account number, which is provided on the Statement of Overpaid Unemployment Benefits Account letter sent to you. You choose when to send the payment and select the payment amount. Any fees are controlled by your bank or credit union and are not associated with TWC.

A Notice of State Payment Held is a letter the Texas State Comptroller sends to notify you when they recover an unemployment benefits overpayment by withholding certain payments to you, such as lottery winnings. This is also called a warrant hold.

The state cannot pay you unclaimed property, lottery winnings, unemployment benefits, or state job-related expenses until you repay the benefits overpayment in full. For example, if you have a Texas state government job and turn in travel expenses, the Comptroller sends your travel reimbursement payment(s) to TWC to repay your overpayment.

To pay off your overpayment faster, complete the Voluntary Offset on the back of your Notice of State Payment Held letter and send it to the State Comptroller as instructed. If the warrant amount exceeds the overpayment debt, the Voluntary Offset also will allow the Comptroller to speed up the processing of the balance to be paid to you.

For information on how to provide full payment to TWC to release a Comptroller’s payment hold, call Benefit Overpayment Collections at 512-936-3338.

If an overpayment meets certain criteria, TWC may file an Abstract of Assessment in the county of record. An Abstract of Assessment, similar to a property lien, has the effect of a civil suit. If you are served with an Assessment and do not agree with the overpayment, you or your attorney may file a Notice of Judicial Review with the District Court of the respective county.

To request the payoff amount for your overpayment, send a fax to Benefit Overpayment Collections at 512-936-3799. Include the reason for your request and a copy of the Abstract of Assessment.

For information on how to pay off your overpayment to release the Abstract of Assessment, call Benefit Overpayment Collections at 512-936-3338.

If you have an overpayment of unemployment benefits, and have not repaid that debt, your federal Internal Revenue Service (IRS) tax refunds may be subject to reduction by the overpaid amount.

The Treasury Offset Program (TOP) is a federal program that collects past due debts owed to federal and state agencies by capturing IRS tax refunds to offset these debts. TWC issues letters to former unemployment benefit claimants who have debts that are subject to collection through TOP.

Federal law requires TWC to collect specific types of unemployment benefit debt from both claimants and employers. Claimants with an overpayment caused by incorrectly reported earnings, fraud and fraud penalties are subject to TOP.

Collection through TOP is only initiated after an overpayment determination is final and other collection notices have failed. If you have an overpayment that is subject to TOP, TWC will mail a letter showing the amount you owe, along with instructions on how to avoid referral to collection. You must complete one of the following actions within 60 days of the mail date of the letter to avoid collection through TOP:

- Submit full payment of the amount indicated.

- Enter into a six-month repayment plan and submit the first monthly payment.

- Submit documentation showing that you have paid the debt in full.

- Submit documentation explaining why the amount is not subject to TOP referral, such as a bankruptcy ruling.

Send payment or documentation to:

TOP Overpayment Collections

PO Box 149007

Austin, TX 78714-9007

As part of the TOP collection process, TWC is required to notify you of our intent to refer the debt to TOP for collection 60 days before referral in order to give you the opportunity to either make payment arrangements or explain why the debt should not be considered subject to TOP collection. Receiving a Notice of Intent to Offset letter does not give you an additional opportunity to appeal the original decision that caused the overpayment. If you have already paid the amount in question or have addressed the debt in a bankruptcy filing, you will need to provide information regarding these actions.

For additional information on TOP, you can review the Bureau of the Fiscal Service websites:

For laws relating to TOP you can visit:

We mail important documents to the most recent address we have for you. Be sure to change your address as needed, so that you will receive all documents.

If you lost or did not receive documents we mailed to you, see TWC Open Records for instructions on requesting copies.

If you filed for bankruptcy, call 512-936-3338 and provide your case number and date of the bankruptcy filing. We will verify your bankruptcy status and add that information to your account.

While a bankruptcy case is active, we will temporarily stop overpayment recovery actions. If your overpayment debt is discharged in bankruptcy, we will permanently stop all recovery of benefits. If the bankruptcy is dismissed, your repayment obligation continues and we will resume overpayment recovery.

If a claimant with an overpayment dies, the person managing the deceased person’s affairs should mail or fax a copy of the death certificate to TWC. The death certificate does not need to be certified. If there is a Texas State Comptroller’s payment hold on the deceased claimant’s account, we will request that the overpayment be repaid using funds from a probated estate and funds payable under the deceased claimant’s Social Security number.

- Mail:

TWC Benefit Overpayment Collections

101 E. 15th St, Rm 556

Austin, TX 78778-0001 - Fax: 512-936-3799

You do not need to contact TWC for the repayment schedule to take effect

Contact the Collections department for questions about repaying the overpayment, such as requesting a change to the payment schedule, the balance of your overpayment, warrant holds, a TOP notice, or a Notice of Assessment.

Mail: Benefit Overpayment Collections

Texas Workforce Commission

101 E 15th St, Rm 556

Austin, TX 78778

Phone: 512-936-3338

Fax: 512-936-3799

Email: special.colloverpay@twc.texas.gov - Please use this email address only for questions about repaying the overpayment. To discuss why you were overpaid, make corrections to your claim, or any other questions about your claim, please contact the Unemployment department at 800-939-6631 or by submitting a Contact Request Form.

Notice of Potential Overpayment

If you received a Notice of Potential Overpayment letter asking you to contact the Benefit Payment Control (BPC) department, please contact them for assistance.

Phone: 800-950-3592

The Collections department is not able to assist with a Notice of Potential Overpayment letter and cannot make changes to your earnings.