This page provides information on the eligibility requirements for unemployment benefits and answers to common questions regarding various special circumstances.

Unemployment Benefits Eligibility

TWC evaluates your unemployment benefits claim based on:

- Past wages

- Job separation(s)

- Ongoing eligibility requirements

You must meet all requirements in each of these three areas to qualify for unemployment benefits.

Past Wages

Your past wages are one of the eligibility requirements and the basis of your potential unemployment benefit amounts. We use the taxable wages, earned in Texas, your employer(s) have reported paying you during your base period to calculate your benefits. If you worked in more than one state, see If You Earned Wages in More than One State below.

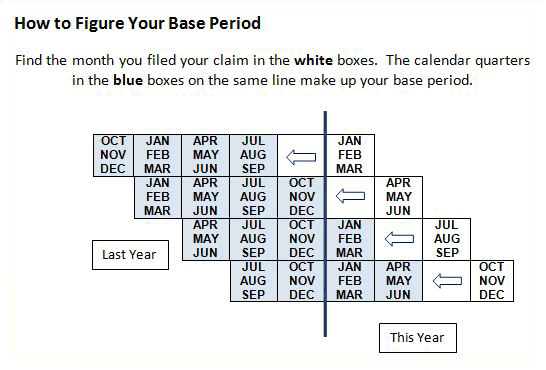

Base Period

Your base period is the first four of the last five completed calendar quarters before the effective date of your initial claim. We do not use the quarter in which you file or the quarter before that; we use the one-year period before those two quarters. The effective date is the Sunday of the week in which you apply. The chart below can help you determine your base period. If you do not have enough wages from employment in the base period, TWC cannot pay you benefits.

To have a payable claim, you must meet all of the following requirements:

- You have wages in more than one of the four base period calendar quarters.

- Your total base period wages are at least 37 times your weekly benefit amount.

- If you qualified for benefits on a prior claim, you must have earned six times your new weekly benefit amount since that time.

Alternate Base Period

You may be able to use an alternate base period (APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

You will need to provide documentation to substantiate:

- The date and nature of your illness, injury, disability, or pregnancy. It must be medically verifiable, i.e., substantiated by a health care practitioner, a health professional, or evidenced by sufficiently strong physical facts.

- You were unable to work for a period of seven weeks in one or more quarters during your regular base period.

- You had more work in your alternative base period than in your regular base period. This may require employment and wage history.

Types of Job Separation

To be eligible for benefits based on your job separation, you must be either unemployed or working reduced hours through no fault of your own. Examples include layoff, reduction in hours or wages not related to misconduct, being fired for reasons other than misconduct, or quitting with good cause related to work.

Laid Off

Layoffs are due to lack of work, not your work performance, so you may be eligible for benefits. For example, the employer has no more work available, has eliminated your position, or has closed the business.

Working Reduced Hours

If you are working but your employer reduced your hours, you may be eligible for benefits. Your reduction in hours must not be the result of a disciplinary action or due to your request.

Fired

If the employer ended your employment but you were not laid off as defined above, then you were fired. If the employer demanded your resignation, you were fired.

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Quit

If you chose to end your employment, then you quit. Most people who quit their jobs do not receive unemployment benefits. For example, if you quit your job for personal reasons, such as lack of transportation or stay home with your children, we cannot pay you benefits.

You may be eligible for benefits if you quit for one of the reasons listed below:

- Quit for good cause connected with the work, which means a work-related reason that would make an individual who wants to remain employed leave employment. You should be able to present evidence that you tried to correct work-related problems before you quit.

Examples of quitting for good work-related reason are well-documented instances of:- Unsafe working conditions

- Significant changes in hiring agreement

- Not getting paid or difficulty getting your agreed-upon pay

- Quit for a good reason not related to work, under limited circumstances. Examples include leaving work because:

- A personal medical illness or injury prevented you from working

- You are caring for a minor child who has a medical illness

- You are caring for a terminally ill spouse

- You have documented cases of sexual assault, family violence or stalking

- You entered Commission-Approved Training and the job is not considered suitable under Section 20

- You moved with your military spouse

- Quit to move with your spouse when the move is not part of a qualifying military permanent change of station (PCS). You may be eligible for benefits but you will be disqualified for 6 to 25 weeks, depending on the situation. Your maximum benefit amount is also reduced by the number of disqualified weeks.

Labor Dispute

If you are involved in a labor dispute or strike, see more information at If You are Involved in a Labor Dispute or Strike below.

Ongoing Eligibility Requirements

In addition to the past wages and job separation eligibility requirements, there are requirements you must continue to meet to stay eligible. See Ongoing Eligibility Requirements for Receiving Unemployment Benefits.

Benefit Amounts

We will mail you a statement with your potential benefit amounts after you file your claim. You may use the TWC Benefits Estimator to estimate your potential benefit amounts. The estimator cannot tell you whether you qualify for unemployment benefits.

Your benefit amounts are based on your past wages. How we calculate benefits is explained below.

Weekly Benefit Amount

Your weekly benefit amount (WBA) is the amount you receive for weeks you are eligible for benefits. Your WBA will be between $75 and $605 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages.

To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

If you work during a week for which you are requesting payment, you must report your work. Wages earned may affect your benefit amounts.

Maximum Benefit Amount

Your maximum benefit amount (MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

Your benefit year begins on the Sunday of the week in which you applied for benefits and remains in effect for 52 weeks. Your benefit year stays in effect for those dates even if TWC disqualifies you or you receive all of your benefits. You may run out of benefits before your benefit year expires.

Minimum and Maximum Weekly Benefit Amounts from 2010 to Present

| Start Date | Minimum WBA | Maximum WBA |

|---|---|---|

| October 5, 2025 | $75 | $605 |

| October 6, 2024 | $74 | $591 |

| October 2, 2023 | $73 | $577 |

| October 2, 2022 | $72 | $563 |

| October 3, 2021 | $71 | $549 |

| October 4, 2020 | $70 | $535 |

| October 6, 2019 | $69 | $521 |

| October 7, 2018 | $68 | $507 |

| October 1, 2017 | $67 | $494 |

| October 2, 2016 | $66 | $493 |

| October 4, 2015 | $65 | $479 |

| October 5, 2014 | $64 | $465 |

| October 6, 2013 | $63 | $454 |

| October 7, 2012 | $62 | $440 |

| October 2, 2011 | $61 | $426 |

| October 3, 2010 | $60 | $415 |

Special Sources of Wages or Types of Employment

The following sections include details for special situations.

Benefit Options for Wages in More than One State

If you worked in more than one state during your base period as defined in Eligibility & Benefit Amounts above:

- You can apply for benefits in any state where you have base period wages. The state you choose will become your paying state. See Potential Benefit Amounts and Contact Information by State below.

- You may either:

- Ask the paying state to combine all of your wages in a single unemployment benefits claim. If you combine wages, you can only receive benefits from one state. If you earned enough wages in your paying state to qualify for the maximum benefit amount, then the paying state will not combine wages from other states on your claim.

- Use only the wages earned in the paying state. Then based upon the law and base period provisions of the other states where you have wages, you may be able to use those other state wages to apply for benefits in the future.

The paying state will process your unemployment benefits application according to the rules of that state. The paying state asks the other state(s) to transfer your wage records. The paying state can then determine if you earned enough wages after combining wages from other states to qualify for benefits under that state’s laws.

To be eligible for benefits, you must register and search for work in the state you live in and comply with ALL of its requirements. TWC will verify that you registered in the state you live in. Find your state’s job bank here.

Potential Benefit Amounts and Contact Information by State

The following table shows the minimum and maximum weekly unemployment benefit amounts and contact information for unemployment benefits in each state. States may change their benefit amounts at any time, so amounts included here may not be current.

To apply for unemployment benefits, find the state(s) where you worked, then go to that state’s website or call the number listed in the table.

To apply for benefits from the Virgin Islands, call us at 800-939-6631. We will take your application by phone and send it on your behalf.

*Last update: October 27, 2025

See Also

If you worked in Texas during your base period as defined in Eligibility & Benefit Amounts above, but you are now living in another state or Canada, you apply for unemployment benefits in Texas.

Apply for benefits in one of two ways:

- Apply online at Unemployment Benefit Services by selecting Apply for Benefits. Read the Applying for Unemployment Benefits Tutorial (Español) for help applying online.

- Call a Tele-Center at 800-939-6631 and speak to a customer service representative.

TWC makes the determinations about payment and pays any eligible benefits.

You must register for work search assistance with the One-Stop Career Center in the state where you reside within three days of applying for benefits and meet your required weekly work search activities. You can find workforce services near you using America’s Service Locator. We will verify that you registered with your state of residence.

See Also

Claim Requirements

If you worked as a federal employee during your base period as defined in Eligibility & Benefit Amounts above, you need to estimate your federal wages when you apply for unemployment benefits. The federal government does not report wages to TWC each quarter as other employers do, so we must get wage information from you before we can calculate your benefit amounts.

Most people who worked for the federal government can use federal wages to establish their benefit amounts.

- If you worked as a federal civilian employee, you can use federal wages on your claim.

- If you worked as a contract worker, and received an IRS Form 1099 instead of a W-2, you may not be able to use those wages on your claim. The federal agency you worked for will tell us whether the work you did was considered federal civilian employment and can be used for unemployment claim purposes.

Apply for benefits in one of two ways:

- Apply online at Unemployment Benefit Services by selecting Apply for Benefits. Read the Applying for Unemployment Benefits Tutorial (Español) for help applying online.

- Call a Tele-Center at 800-939-6631 and speak to a customer service representative.

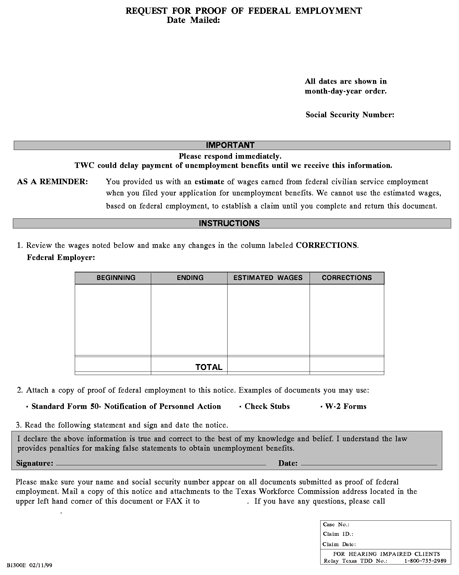

Request for Proof of Federal Employment

After you apply for benefits, TWC mails you a Request for Proof of Federal Employment form (pictured below) showing the federal wages you estimated.

You must do all of the following before we can use your federal wages to calculate your benefit amount:

- Review the wages and make necessary corrections.

- Sign the form.

- Attach proof of federal employment or federal wages.

- Return the form and proof of employment/wages to TWC.

Acceptable Proof of Federal Employment

The most common proof of federal employment is a Standard Form SF-50 Notice of Personnel Action, or equivalent. A W-2 form or pay stub is also acceptable. Proof should have your name, Social Security number, the employing agency name and clearly indicate you were an employee. You cannot use Standard Form SF-8 as your only proof of employment, because it does not include personal identification.

We also request wage information directly from your former federal employer. When we receive wage information from your employer, we update your wage estimate with the information from the federal government.

If You Disagree with Wage or Separation Information

If you disagree with the information we receive from the federal government, call our Tele-Center at 800-939-6631 and speak with a customer service representative. We will ask the federal agency to reconsider their findings about your wages or reason for separation. If you disagree with the federal agency’s reconsideration report, you may file an appeal with TWC. The TWC hearing officer will make an independent ruling on your wages and reason for separation.

See Also

Claim Requirements

If you served in the military during your base period as defined in Eligibility & Benefit Amounts above, your military wages qualify you for benefits if:

- You are physically in Texas when filing the claim.

- You received a DD Form 214 when separated.

- You separated under honorable conditions and completed your first full term of service.

- You did not complete your first full term of service, but you separated early for a reason specified by Congress as an exception to the full-term requirement on your claim.

- You served at least 180 days of continuous active service as a reservist or member of the National Guard.

Apply for benefits in one of two ways:

- Apply online at Unemployment Benefit Services by selecting Apply for Benefits. Read the Applying for Unemployment Benefits Tutorial (Español) for help applying online.

- Call a Tele-Center at 800-939-6631 and speak to a customer service representative.

Proof of Military Service

The following sections are about the military information that TWC requests.

Provide TWC with DD Form 214

TWC requests your military information from the Federal Claims Control Center (FCCC). If there is no DD Form 214 on file with the FCCC, they will notify TWC. TWC will then send you a notice asking you to send us a copy of your DD Form 214. We also request separation information directly from the military. We must have either your DD Form 214 or separation information from the military to use your military wages to calculate your benefit amounts.

Only send your DD Form 214 to us if we ask for it. If we send you a notice asking you to send a copy of your DD Form 214, submit it using our online UI Submission Upload portal (Portal de UI). The DD Form 214 must be a valid copy, not a worksheet. The copy must also be marked as Member 2 through 8 or Service copy. We cannot use Member 1 (or short version) because it does not have all the required facts. If you do not have your copy of DD Form 214, you can request a copy by following the instructions on the National Archives website.

After we receive the DD Form 214 from you or separation information from the military, we determine if we can use your military wages to calculate your benefit amounts.

- We calculate military wages using information on your pay grade at the time of your separation.

- We also use information such as the term of service, character of service, or narrative reason for separation.

- We will send a decision stating if we can use your military wages.

If You Disagree with DD Form 214

Information on your DD Form 214 can prevent us from using your military wages to qualify for benefits. If you disagree with the information on your DD Form 214, you can apply to your branch of service to change the DD Form 214 information. To request changes, submit a Department of Defense DD Form 149, Application for Correction of Military Record, to the appropriate address on the back of the form. You can download DD Form 149 from the National Archives website or get one from your local Workforce Solutions office.

While you are waiting for a decision from the military, you must continue to request payment as long as you are unemployed. If you have questions about a military appeal, contact your branch of service.

If You Receive Military Retirement or Disability Pay

You must report any military retirement pension or disability pay to TWC when you apply for benefits or by calling a Tele-Center at 800-939-6631. We may be required to deduct your retirement or disability pay from your unemployment benefits. We will mail you a decision on whether that pay affects your unemployment benefits.

- Military retirement pensions that are paid as periodic payments are deducted from your benefit payments if you have military wages in the base period.

- Disability pay is deducted from your benefit payments if it is paid by the military branch. It is not deducted if it is paid by the U.S. Department of Veterans Affairs.

- If you receive a disability pension, you must be able to work full time to be eligible.

If your military retirement or disability pay is deducted from your benefit payments, we convert the amount of your monthly pension into a weekly amount and reduce your weekly benefit payment by the resulting amount.

See Also

Claim Requirements

If you are a teacher or a school employee working in a non-instructional position, there are two primary factors affecting eligibility:

- Whether you are on a scheduled break:

If you have wages from an educational institution in the base period of your claim, are on a scheduled break in the school year and you have a contract or reasonable assurance of a job as defined below in the next academic term or after the break, you generally would not qualify for unemployment benefits because we cannot use your school wages to calculate your benefit amount. - Type of job separation:

If you lose your job through no fault of your own, you might qualify for unemployment benefits. TWC determines eligibility for benefits is determined on a case-by-case basis.

Apply for benefits in one of two ways:

- Apply online at Unemployment Benefit Services by selecting Apply for Benefits. Read the Applying for Unemployment Benefits Tutorial (Español) for help applying online.

- Call a Tele-Center at 800-939-6631 and speak to a customer service representative.

Reasonable Assurance

Reasonable assurance is a commitment, either written or verbal, that you will have a job after scheduled breaks or in the next academic term at your school or any other school.

We cannot use your school wages in your base period, as defined in Eligibility & Benefit Amounts above, to calculate your benefit amounts if you are on a scheduled break and any of the following apply:

- You have reasonable assurance of a school job

- You sign up as a substitute teacher with any school

- You accept a job with any educational institution

If you have sufficient wages from a non-school job to qualify for benefits, we may be able to pay benefits based on the non-school wages.

If you receive reasonable assurance or get a school job after you apply for benefits, call a TWC Tele-Center immediately at 800-939-6631.

Resignation or Retirement

Keep in mind the following regarding resignations and retirements.

Incentives to Resign or Retire

Some schools offer financial incentives to persuade employees to resign or retire. If you voluntarily accept these incentives, you might not qualify for benefits. However, if your employer would have laid you off anyway, you might qualify even though you resigned or retired.

Resign Rather than Accept Layoff

If you sign a resignation letter rather than accept a layoff, it may affect your benefits. Leaving a job voluntarily might disqualify you from receiving benefits. However, you may receive benefits if your employer would have let you go because of budget cuts, regardless of whether you signed the letter of resignation.

Receiving Retirement Pension

If you qualify for unemployment benefits, we will reduce your weekly benefits by any pension amount you received from an employer whose wages we used to calculate your benefits.

See Also

Last Worked for a Temporary Help Agency

To be eligible for benefits, each time you complete an assignment for a temporary help agency, you must:

- Contact the agency according to their guidelines no later than the next business day.

- Allow the agency three business days after your last assignment ends to offer you a new assignment before you apply for benefits. Waiting three days does not apply if you have an active claim and are submitting payment requests.

Temporary help agencies are required to tell you the following:

- You must contact the agency immediately after the completion of each assignment to receive another assignment.

- You may not qualify for benefits if you do not follow all the agency’s procedures.

Apply for benefits in one of two ways:

- Apply online at Unemployment Benefit Services by selecting Apply for Benefits. Read the Applying for Unemployment Benefits Tutorial (Español) for help applying online.

- Call a Tele-Center at 800-939-6631 and speak to a customer service representative.

Last Worked for a Professional Employer Organization

When a company pays you through a professional employer organization (PEO, also known as a staff leasing company), the PEO’s name is on your paycheck or pay stub. The PEO is your employer. You must follow the PEO’s rules, including those on requesting and completing assignments.

To be eligible for benefits, each time you complete an assignment for a PEO, you must contact the PEO no later than the next business day for a new assignment. The PEO, or the business for which you completed the assignment, must give you a written notice advising you of this requirement after each assignment ends.

Apply for benefits in one of two ways:

- Apply online at Unemployment Benefit Services by selecting Apply for Benefits. Read the Applying for Unemployment Benefits Tutorial (Español) for help applying online.

- Call a Tele-Center at 800-939-6631 and speak to a customer service representative.

See Also

If Work Stopped Due to a Strike

If you or your class of workers are financing, participating in or directly involved in a strike, we cannot pay you benefits during the strike.

- Class of Worker: The grade or class of worker is based on the type of work you performed. For example: If electricians are on strike and you are an electrician then you can be considered the same grade or class of worker that is on strike and will benefit from the strike.

If you are in a supervisory, non-manual classification and electricians are on strike, then you would not be considered in the same grade or class as the electricians. - Financing a Strike: Any payment such as union dues that are used to finance a strike or other payments made to a strike fund that assists striking members.

If you or your class of workers are not financing, participating in or directly involved in the strike, you may be eligible for benefits.

If Work Stopped Due to a Lockout

If your employer stops you from working due to a lockout (for example, the workers want to work but the employer will not let them), then you may be eligible for benefits.

When Disqualification Ends

The disqualification for a strike continues until you no longer have any part in the dispute. It does not matter if you are a member of a labor union. It is not possible to requalify for benefits by working elsewhere. A labor dispute disqualification continues until:

- The dispute is settled, and you report to work. Labor dispute disqualifications do not automatically end when the labor dispute ends. They end when you report to work.

- You make an unconditional offer to return to work during the labor dispute, even if it involves crossing a picket line. If the employer does not put you back to work, you are no longer involved in the labor dispute.

If You Resign

If you officially resign during the labor dispute, we can end your unemployment benefits disqualification for the labor dispute. However, we may have to disqualify you for quitting your last work without good cause. This does not apply to a lockout.

See Also

If you lost your job because of increased foreign imports or shifts in production to foreign countries, you may be eligible for Trade Adjustment Assistance (TAA). You should ask your local Workforce Solutions office staff about eligibility for TAA as soon as possible because there are time limits on eligibility, training, and benefits.

To receive benefits under the TAA program, you must have been laid off from a job covered under a TAA certification issued by the U.S. Department of Labor (DOL). A petition for that TAA certification may be submitted to DOL by your former employer, a group of at least three affected workers, or Workforce Solutions office staff.

Staff at your local Workforce Solutions office can tell you whether your company is covered by a TAA certification, and if so, give you the petition number, or provide you with petition forms. The petition number is important because eligibility and benefits are tied to that specific petition, which reflects applicable law and rule.

Trade-affected workers covered by a DOL-certified petition may participate in TAA programs. Benefit eligibility information described below on this page is listed by petition number range.

Possible Trade Adjustment Assistance (TAA) benefits for eligible workers include:

- Reemployment services

- Job search and relocation allowances

- TAA-paid training to prepare for new jobs

- Weekly benefits called a Trade Readjustment Allowance (TRA), which pays supplemental benefits similar to unemployment benefits.

- Alternative/Reemployment Trade Adjustment Assistance

- Health Coverage Tax Credit (HCTC)

Under the current law governing the TAA program, the program expired on July 1, 2022, and phase-out activities began. However, TWC will continue to determine eligibility and provide services to workers covered under certified petitions.

The following sections provide details on the program.

Trade Adjustment Assistance Benefits & Requirements

The following are benefits and requirements of the TAA program.

Reemployment Services

Trade-certified workers are eligible for services including job search assistance, skills assessments, and advanced vocational skills training to meet the needs of Texas employers as well as other assistance, such as transportation reimbursements and child care while in training provided through Workforce Solutions offices.

Job Search & Relocation Allowances

If your Workforce Solutions office counselor confirms that there is no suitable work for you in your local area, then you may be eligible for job search and relocation allowances. This may mean we can pay for allowable expenses for your out-of-town job search trips and/or moving expenses when you relocate for a job.

Job Search Allowances

- Have at least one scheduled job interview with someone with hiring authority in the area of the job search trip.

- Before each job search trip, submit a written Request for Job Search Allowance form.

- Get the form at the local Workforce Solutions office and submit to the TAA State Unit by email at: TAA@twc.texas.gov or fax to 512-936-0331.

- Make your written request no later than 365 calendar days after the date of your trade certification or after your most recent trade-affected layoff, whichever is later, or no later than 182 calendar days after completing TAA approved training.

- Keep your receipts from the job search trip and fill out your Daily Record/Itinerary we gave you when your request was approved. You both get the form and submit it through your Workforce Solutions counselor.

Relocation Allowance

- Have a suitable, long-term, verifiable job or have a valid offer of a job where you want to move.

- Before you begin the move, submit a written Request for Relocation Allowance. Get the form at the local Workforce Solutions office and submit to the TAA State Unit by email at: TAA@twc.texas.gov or fax to 512-936-0331.

- Make your written request no later than 425 calendar days after the date of your petition certification or after your most recent trade-affected layoff, whichever is later, or no later than 182 calendar days after completing TAA-approved training.

- TAA pays to move only your household goods and personal property as defined in federal regulations. For details, contact the Trade Services Unit by email at: TAA@twc.texas.gov before you begin moving.

- TAA does not pay for moving expenses paid by other sources, such as your employer.

TAA-Paid Training

If your Workforce Solutions counselor determines that there is no suitable work available to you, you may be eligible for training to prepare for a new job through Trade Adjustment Assistance. You should apply for Trade Adjustment Assistance-approved training as soon as possible in order to meet TAA deadlines.

How to Apply for TAA Training

Visit your nearest Workforce Solutions office to apply for TAA-approved training. Identify yourself as a trade-affected worker and ask to speak to a TAA counselor.

Workforce Solutions staff will assess your job skills and discuss benefits available for TAA participants and talk with you about your options. If you need training to obtain suitable work, you may be eligible for training with costs for tuition, fees and books covered by TAA funds.

The Workforce Solutions office staff will notify you when your training application has been approved and the training institution notifies the Workforce Solutions office that it has accepted you into an approved training program. You must start training within 30 calendar days of the enrollment date.

Types of TAA Training Available

Training covered under the Trade acts include classroom training, on the-job training, customized training designed to meet the needs of a specific employer or group of employers, apprenticeship programs, post-secondary education, prerequisite education or coursework and remedial education, which may include GED (Graduate Equivalency Degree) preparation, literacy training, basic math or ESL (English as a Second Language). The state of Texas uses TAA funds to pay the training provider.

To be supported under TAA, training must be fully completed and all certificates or degrees secured within the maximum timeline permitted under your petition number.

- 80,000 or greater: 130 weeks

- 70,000 through 79,999: 156 weeks

- 50,000 through 69,999: 130 weeks

- Less than 50,000: 104 weeks

Depending on your petition number, you may be approved to receive part-time or full-time training. Your eligibility for other types of TAA benefits may depend upon whether you are in full-time or part-time training; see the specific eligibility requirements for each type of TAA benefits.

If your petition number is 70,000 or higher and you are working but threatened with layoff, you may be eligible to enroll in a TAA-approved training program.

Eligibility for TAA Training

If your Workforce Solutions counselor determines that you meet the following requirements, you may be eligible for a TAA-approved training program:

- No suitable employment is available.

- You would benefit from appropriate training.

- There is a reasonable expectation of employment following completion of training.

- Training is reasonably available.

- You are qualified to undertake and complete such training.

- Training is available at a reasonable cost.

Trade Readjustment Allowance

Trade Readjustment Allowance (TRA) benefits are similar to regular unemployment benefits. You must apply for and exhaust regular and any available extended unemployment benefits to receive TRA benefits.

To receive TRA benefits you must participate in TAA-approved training or have a waiver of the training requirement. Some TRA benefits can only be paid while you are in TAA-approved training. It is important to start and complete your training quickly, while you have TRA benefits to help cover your living expenses during training.

To learn more, see Trade Readjustment Allowance Benefits.

Resources

- Workforce Solutions offices

- Trade Readjustment Allowance Application (English)

- Trade Readjustment Allowance Application (Español)

- TAA Handbook (English)

- TAA Handbook (Español)

- U.S. DOL Trade Adjustment Assistance Program

See Also

Child Support Obligation

If you owe court-ordered child support, we will reduce your weekly payment by up to 50 percent to pay your child support. The Office of Attorney General (OAG) notifies TWC if you owe child support. We deduct the amount directly from your payment and send the funds to OAG, who will give the money to the custodial parent.